Russian cryptocurrency surge after digital asset exchanges hold out against blocking Russian users.

- Tomas Jacinto

- Apr 11, 2022

- 2 min read

After the barbarian Russian invasion against a peaceful country, many nations of the west sought out to sanction Russia in an attempt to stop these attacks. The biggest sanction pack ever, saw Russia get blocked from SWIFT. SWIFT which stands for Society for Worldwide Interbank Financial Telecommunication, allows banks to relay information about financial transactions to one another. Since, Russian banks have been blocked from making transactions outside of Russia.

However, Crypto Currencies which are a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, came under pressure after having decided to not block Russian users from their platforms. Since the assault of Ukraine, Bitcoin and Tether (the biggest cryptocurrencies) have started trading around $60 million a day.

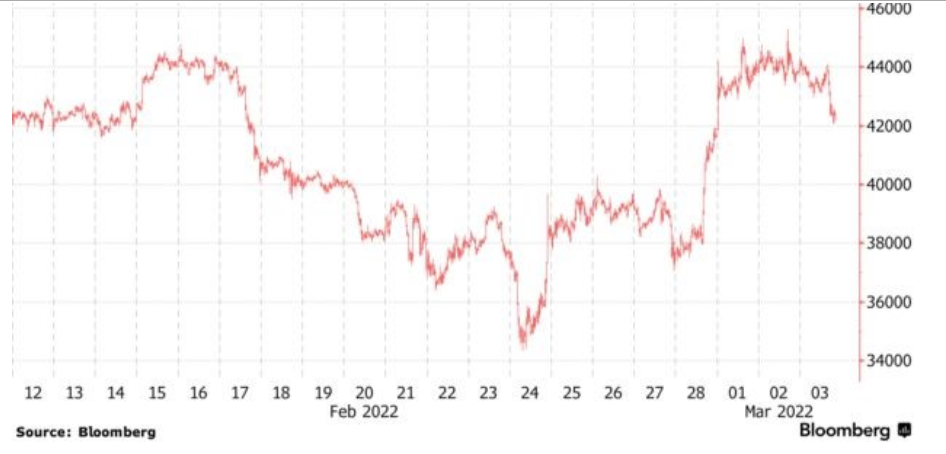

Chainalysis, a crypto currency research group, have suggested that Russian accounts are the cause of this surge and that crypto may be used as a way for citizens of Russia to move wealth overseas unsanctioned. This can be seen in the price increase for Bitcoin, suggested Citigroup Inc. (see graph)

When asked, Binance, a Cayman Islands registered, crypto currency giant responded by saying:

“To unilaterally decide to ban people’s access to their crypto would fly in the face of the reason why crypto exists.” Rival Okx, based in Seychelles also stated that it had no plan to ban Russian accounts. In response MP Tom Tugendhat (chair of the UK House of Commons foreign affairs committee) said:

“There remains a considerable risk of Russian individuals and entities sanctioned last week continuing to trade in cryptocurrency assets”

However, there may be longer-term consequences of the role of crypto in unlawful transactions. As “Governments are likely to look at the regulation of crypto as a matter of increasing urgency.”, said Paul Donovan, chief economist at UBS Global Wealth Management.

Article by Tomás Jacinto.

Comments